Fossil Counter-offensive

By Christian Zeller

- Introduction

The perspective of green capitalism is based on a comprehensive energy transition from fossil to renewable energy sources. Since the 2009 climate conference in Copenhagen governments, corporations and opposition parties have been relying on the assumption that the energy companies can be persuaded to rethink their business and initiate a transition process towards renewable energy and engagement in the “green” economy. That reliance has only increased since the climate talks in Paris in 2015.

But it’s not just politicians and business. Scientists and important parts of the climate justice movement have also adhered to this idea. Most concepts of a socio-ecological transition and a “Green New Deal” assume that somehow fossil capital can be integrated into a transformation perspective.

Several theoretical arguments speak against this assumption. So does the historical experience of comprehensive social and industrial restructuring processes.

Under what conditions will capital leave fossil sectors and flow into “green” sectors when profitability in non-fossil sectors is lower? This would require a major government investment drive in building renewable energy infrastructure. Covering electricity peaks also requires redundant infrastructure. This is not currently happening anywhere.

In addition, what would governments use to finance these investments? Comprehensive taxation of the wealthy would be tantamount to a declaration of war. The construction of the gigantic infrastructure for energy storage and electric transmission networks will keep energy prices high for consumers for a long time. So here, too, the state would have to intervene to keep renewable energies reasonably cheap.

A look at the investments in different energy sectors in the last years reveals that a transition to renewable energies is taking place only sluggishly. The scale does not correspond in any way to what is needed to slow down global warming. The energy price increases since 2021 were accentuated by the Russian war against the Ukrainian population in 2022. Those prices caused the profit margins in the fossil sector to skyrocket. Prices have fallen again since then, and profitability is unlikely to stay at the 2022 level. Nevertheless, the reports from the headquarters of the major oil companies suggest that a real energy turnaround is even more unrealistic than might have been hoped a few years ago.

In this article, I argue that after several years of restrained investment activity, fossil capital is once again increasingly investing in the renewal and expansion of fossil infrastructure. Coupled with government policies in the major capitalist states, there is even a real fossil backlash.

The reluctance of fossil corporations in the previous period and their renewed confidence now both stem from a combination of political and economic factors. On the one hand, low fuel prices in the aftermath of the 2008 economic crisis and subsequent years caused profit margins to shrink. On the other hand, the strengthening climate justice movement led to expectations that governments would place hurdles in the way of fossil fuel infrastructure investments.

This situation has fundamentally changed. Uncertainty has given way to confidence that fossil infrastructure investments will continue to be highly profitable for many years to come. If stranded assets do pile up, the industry is relying on its own strength to extract large compensation payments from states – and thus societies. The climate justice movement is proving too weak to force corporations to phase out fossil fuels. With energy security fears growing in the wake of Russia’s war on the Ukrainian people, almost all governments are now committed to a major expansion of gas infrastructure. The largest energy companies would not make their renewed investments if they did not have the certainty of profitable returns – or at least the certainty of substantial government subsidies in the event of devaluation.

I will now proceed in three steps. First, I will formulate some observations on the political landscape. Then, I will shed light on the investment behaviour of fossil corporations and show some examples to illustrate this behaviour. In the conclusion I will name the basic challenges for the climate justice movement and the ecosocialist current.

2. Political backlash

The mobilizations of the climate movement before the start of the pandemic were huge. And in recent months there have again been broad-based demonstrations and civil disobedience in many countries. Still, there is a critical balance to be made. Jonathan Neale does that in more detail in this issue. I only touch on a few facts here.

The climate justice movement has not been able to get unions in any country to adopt truly substantive climate policies. For example, the recent extensive mobilization of workers and mass strikes in France, Britain and Germany did not integrate the impending climate catastrophe into their demands. Nowhere have unions committed themselves to policies that will ensure that greenhouse gas emissions come down immediately. This inability of the climate justice movement to socially enforce changes in production and transport provides the fossil fuel industry with the certainty that they can extend their development path.

The increasingly severe state repression against activists of the climate justice movement fits into this picture. The activists are to be intimidated and the movement weakened. Morevoer, parts of the movement are to be t integrated into the ruling political system.

COP27 took place last November under the patronage of the dictator Sissi in Sharm el Sheik. This year COP28 will be held in the United Arab Emirates under the leadership of Sultan Al-Jaber, the head of the Abu Dhabi National Oil Company. The climate conference in Sharm el Sheik already avoided a decision a phase-out of fossil fuels. This will also be the tenor of the next COP in Dubai, which will focus on carbon capture technologies. This is a technological bet, because these CCS technologies do not yet exist on the scale required (Hodgson and Williams 2023).

Numerous governments are now clearly indicating that they are backing away from the resolutions of the Paris climate conference. They also want to extend the fossil fuel development path. Sharpened imperialist rivalry and concerns about energy security are reinforcing this trend. These political changes are closely linked to the resurgent inertia of fossil capital.

3. Fossil capital starts a new round of investment

According to the IEA’s (International Energy Agency) World Energy Investment Report, some USD 2.8 trillion is expected to be invested in energy worldwide in 2023. Of this, more than USD 1.7 trillion is expected to flow into supposedly “clean” technologies. The IEA includes into this category renewables, electric vehicles, grids, storage, efficiency improvements and heat pumps, as well as so-called low-emission fuels and nuclear power. Just over $1 trillion will be spent on coal, gas and oil. The organization expects annual investment in so-called “clean energy” to increase by 24% between 2021 and 2023, driven by renewables and electric vehicles.

Fatih Birol, chairman of the IEA, says that investment in solar energy will surpass spending on oil production for the first time this year. That, he says, will help reduce global emissions. But the picture conveyed of an energy transition is deceptive.

High prices have led to an increase in fossil fuel investment, which is expected to rise 15% from 2021 to 23. The IEA expects large and medium-sized oil, gas, and coal companies to increase their investment in new fossil fuels by 6% to $950 billion in 2023. Spending on upstream oil and gas production is expected to increase by 7% in 2023, returning to 2019 levels. They already rose by 11% in 2022. Oil companies in the Middle East, in particular, will invest even more than before the pandemic. Investments in fossil fuels – in coal and oil as well as gas – have increased strongly since 2020 {IEA, 2023 #6730: 12-13, 60-62}.

Net revenues for the global oil and gas industry reached a record high of $4 trillion in 2022. Before that, net revenues had been lower between 2015 and 2021 than they were from 2008 to 2014. But in 2022 fossil fuel producers earned ‘windfall profits’ of $2 trillion. That total was over and above their usual 2021 net revenues. The reason was higher prices. Moreover, in the face of feared energy shortages and high prices, governments, especially in rich economies, have so far allocated well over $500 billion to protect consumers from the immediate impact. In other words, fossil fuel subsidies have increased massively (IEA 2022: 19).

In 2022, most of the cash flow generated by the fossil companies went to dividends, share buybacks and debt repayment. Only a tiny fraction of free cash flow was used for clean energy investments. Financial investment capital thus appropriated much of these profits {IEA, 2023 #6730: 61-62}.

Uncertainty is decreasing and profitability is increasing again. A closer look reveals that investments in less profitable network infrastructure have remained largely at the same level since 2015. This means that “green” investments are lopsided. The less profitable grid infrastructure remains deficient and will become a bottleneck factor.

The IEA warns: “If policymakers and regulators do not provide the necessary incentives for investment in grid spending, it could pose a significant obstacle to the clean energy transition.” In contrast, investment in battery storage has increased massively in recent years, with China responsible for a significant portion of this commitment (IEA 2023: 8, 27, 49, 51, 52).

Finance is a central component of the fossil fuel economy. The world’s 60 largest banks have placed about $5.5 trillion in fossil fuel extraction and production since the 2015 Paris Climate Conference. Placement of financial capital into fossil fuels stabilized in 2020, increased again in 2021, and then declined somewhat in 2022 ($669 billion). That decline was due to uncertain geopolitical and economic conditions, not to a change in bank strategy. Given the record profits in the fossil fuel corporations of $4 trillion in 2022, many could easily self-finance. Exxon Mobil and Shell PLC therefore refrained from bank financing in 2022 (Rainforest Action and et.al. 2023: 4, 16).

It is notable, however, that financial placements in companies serving the fracking and LNG (Liquified Natural Gas) sectors increased significantly. The top 30 companies developing LNG received $23 billion in financing in 2022, up 50% from the previous year. Funding for the top 30 fracking companies totaled $67 billion in 2022, 8% more than in 2021. There are currently 170 liquefacti.on and regasification terminals worldwide. At least as many more terminals are in the project stage (Rainforest Action and et.al. 2023: 5, 72).

The so-called “transition” of the corporations is a long time coming. According to an IEA analysis, the oil and gas industry’s total investment in low-emission energy sources accounts for less than 5 % of total spending on fossil fuel production. Therefore, it is not surprising that global energy-related carbon emissions increased by 0.9 % in 2022 to a record 36.8 billion metric tons. This happened, even though corporations were also spending more money on so-called “clean energy” according to IEA data (Wilson 2023).

4. Texas and Gulf of Mexico

The general trend described above can be illustrated by two current examples. A comprehensive analysis of the fossil counteroffensive remains to be done. For the first example I will look at the British Petroleum (BP) group, because for some time it has tried to give the appearance of wanting to transform itself “Beyond Petroleum”. But in February 2023, BP CEO Bernard Looney announced that the company planned to reduce its oil and gas production by only 25 % by 2030. By contrast, the target set in 2020 during a historic oil price slump had called for a 40 % reduction. This change in strategy by BP exemplifies the fossil capital’s energetic desire to extend its development path.

BP said goodbye to its plan to cut oil and gas production after rising fossil fuel prices helped the British energy company post its highest annual profit – $28 billion – in its 114-year history. CEO Bernard Looney, however, deflects responsibility for this. “Governments and societies around the world are asking companies like ours to invest in today’s energy system,” he told the Financial Times (7 February 2023).

However, the company is primarily responsible to the financial capital that has been placed. And that capital has called for action. That’s because total shareholder return at BP since February 2020 has been the lowest among Western energy companies. None of the other companies have set a formulated target for reducing oil and gas production. Many investors argue that a shift to renewables hurt profits, and that is why the performance of the company’s shares lagged its peers. Wall Street preferred the strategies of ExxonMobil and Chevron, which are avowedly committed to oil. Thus, the finance capital placed wants BP to also hold on to high-yield fossil fuel projects (Wilson and Dunkley 2023; Jacobs 2023; Jacobs, et al. 2023).

This April BP began pumping crude oil through a new $9 billion Argos offshore platform in the Gulf of Mexico. This is BP’s first new platform and largest investment in the region since the Deepwater Horizon explosion and oil spill in 2010. That took the lives of 11 people and caused the largest environmental disaster in U.S. history. With the commissioning of the huge Argos oil platform, BP clearly marks its departure from “Beyond Petroleum” (Jacobs 2023).

Argos can pump 140,000 barrels of oil and gas per day from fields under thousands of feet of water. The platform will increase the company’s production capacity in the region to 400,000 barrels per day, or nearly 20% of the group’s total global production.

CEO Looney affirmed that the commissioning of Argos shows that the company is “investing in today’s energy system.” He said this platform will strengthen the company’s position in the Gulf of Mexico, where it is the largest producer, in the coming years (Jacobs 2023).

“The Gulf of Mexico has some of the best barrels we’ve got and we want to explore and develop more,” Starlee Sykes, head of BP’s Gulf of Mexico business, said in an interview with the Financial Times (Jacobs 2023). BP sees the possibility of increasing oil production in the region for decades to come, she added, even as the company pursues a goal of achieving net zero emissions by 2050.

Stopping oil production now would be “simply impractical”, Looney told the Economic Club of Washington, DC. He suggested that such a move would risk a renewed economic crisis (Jacobs, et al. 2023).

BP is vigorously implementing this counteroffensive. When the corporation scaled back its climate targets in early 2023, it simultaneously announced a dramatic increase in fossil fuel investment and an aggressive plan to increase U.S. oil production. Since that announcement, BP shares have outperformed those of Exxon (Jacobs, et al. 2023).

5. LNG in the USA and Germany

Building a giant infrastructure for LNG is another area of fossil offensive. Venture Global LNG announced on March 13, 2023, that it would begin the second phase of a giant liquefied natural gas export project in Louisiana. The company plans to massively expand the Plaquemines export facility already under construction on the U.S. Gulf Coast. The total cost of the plant is reportedly $21 billion. It has the capacity to process about 2.6 billion cubic feet of LNG per day, or 2.5% of the U.S.’s gas production of 20 million tons of LNG per year for export. The plant will be among the largest LNG export facilities in the world.

With the approval of the Plaquemines expansion, total U.S. LNG export capacity will exceed 20 billion cubic meters per day in the next few years with projects already committed. This will make the U.S. by far the largest LNG exporter in the world (Brower, et al. 2023).

“It’s a free market and we’re not going to stand in the way,” US Energy Secretary Jennifer Granholm told Energy Source, referring to the huge export capacity currently being built. “What’s good is that we’re expanding our ability to help with energy security,” Granholm said.

In fact, this has nothing to do with a free market. Rather, corporations are ramping up capacity in coordination with the government in a planned way.

ExxonMobil and Cheniere Energy are pushing ahead with other major expansion projects. Cheniere Energy is looking to expand its Sabine Pass LNG plant in Louisiana, already the largest in the U.S. Again, expectations from finance capital are driving the expansion. Venture Global LNG says it has received $7.8 billion for the Plaquemines expansion from a variety of lenders, including Goldman Sachs, Bank of China, JPMorgan Chase, MUFG, and Natixis (Brower, et al. 2023).

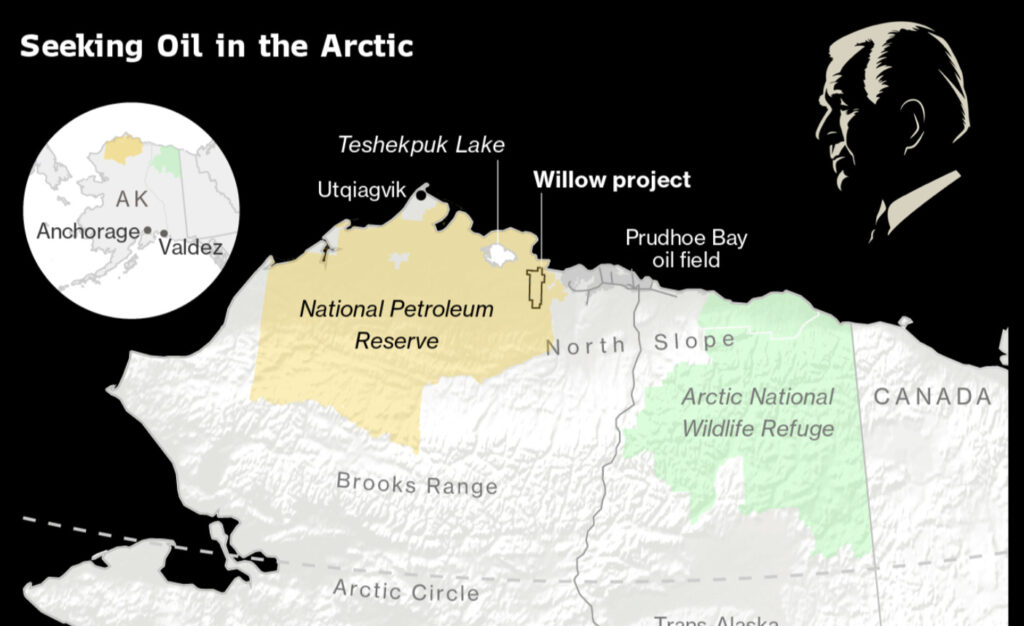

In March the Biden administration also gave the green light to ConocoPhillips’ Willow project on Alaska’s North Slope. According to ConocoPhillips, Willow will produce a peak of 180,000 barrels of oil per day – about 1.5% of current U.S. production. The company will more than double production nationally this year alone (Brower, et al. 2023).

These recent reports should not make us forget that oil and gas production in the Permian Basin in Texas has been expanding at a gigantic rate. And the Permian Basin was already, one of the most prolific oil producing regions in the world. Between 2018 and 2019 alone, oil production there increased by 44%, according to U.S. company Chevron. The region is also a major supplier of natural gas. About 17% of U.S. gas production now comes from the Permian Basin. Not surprisingly, export capacity for LNG is being massively expanded. The high prices for oil and gas have encouraged corporations to massively increase their investments. Unconventional extraction methods such as fracking allow oil to be extracted from deeper layers (Streeck 2023).

The companies are sitting on immeasurable amounts of capital in the form of oil and gas . They will not voluntarily allow this capital to be depreciated. They will continue to claim the profits from these deposits.

All over the world, the fossil offensive is being led and fuelled by government anxious to create competitive conditions for resident corporations. U.S. President Joe Biden, for example, urged domestic oil producers to increase production. All governments in Europe are vigorously building a liquefied natural gas infrastructure. Or they are maintaining purchases of Russian gas, which helps the Putin regime finance its war of conquest against the Ukrainian people. Guaranteed supplies of relatively cheap fossil fuels remain a priority of the ruling policy everywhere.

A brief look at Germany illustrates this tendency. In the wake of the Russian war in Ukraine and energy security fears, European imports of LNG increased by 66% in 2022 (BdEW 2023). Germany previously had no LNG infrastructure because it had benefited from much cheaper pipeline gas from the USSR and then Russia since the early 1970s. This was a key factor in the competitiveness of German industry (Zeller, 2023).

However, even before the Russian war against Ukraine, the German government had laid the groundwork for a massive expansion of LNG even before the Russian invasion of Ukraine. Since the start of the war, the German government has expanded and is rapidly advancing its LNG offensive. By the end of 2026, the government plans to have built a total of eight floating and three fixed LNG terminals. The import capacity of all eleven facilities will amount to around 73 billion cubic meters. This would allow Germany to import about 50% more natural gas than the 46 billion cubic meters it purchased from Russia in 2021.

This suggests that these investments go far beyond replacing Russian gas and aim to develop Germany into a European gas hub with the corresponding power. The German government thus assumes that gas consumption will increase massively. It is ino longer thinking about reducing greenhouse gas emissions in the gas sector to the extent required (Höhne, et al. 2022: 5, 8). The Federal Ministry of Economics plans to have 77 billion cubic meters of import capacity for liquefied natural gas. But only just 7 billion cubic meters of capacity – barely the amount of a terminal ship – would meet “climate targets” (Schlund, et al. 2023; Lohmann 2023).

6. Conclusion: disempowering and expropriating fossil capital

Recent developments confirm a conclusion that can already be drawn from the entire history of fossil capital. The corporations in the oil and gas business, as well as the closely intertwined downstream sectors, such as the automotive and energy industries, are among the most important and powerful fractions of capital. The coal, oil and gas deposits of the corporations are capital waiting to be turned into value. Even under great political pressure, the corporations will not be willing to give up the value of this capital and the expected profits.

The climate justice movement thus faces a comprehensive challenge of power. But our movement alone will not be able to decide the question of power. Only a socially broad movement that includes large sections of workers will be able to build a social and political balance of power that allows the social appropriation of fossil corporations – and thus the smashing of corporate power.

But this alone would does not solve the problems. It would only create the conditions for the possibility of enforcing comprehensive de-fossilization. Fossil capital is decidedly centralized and organized in large transnational corporations. So, social appropriation is not a trivial matter. Public ownership alone in no way guarantees socio-ecological conversion. We are therefore faced with the challenge of enforcing a real democratic socialization. This cannot stop at the borders of nation states.

Questions arise. How can we in Europe initiate the necessary disempowerment of fossil capital? How can we dismantle and covert the fossil infrastructure? How can we construct an ecological and socially just energy infrastructure in a coordinated manner on the continental level?

But the most urgent task now is to transform the climate justice movement into a comprehensive social movement. We need a movement that also embraces the essential concerns of workers in their workplaces, homes, and everyday lives, in a way that aims for an ecologically compatible social metabolism with nature. To advance this orientation, we need to build a strong revolutionary ecosocialist current that understands these challenges and helps to broaden and radicalize the movement.

Literature

Brower, Derek; Jacobs, Justin; McCormick, Myles und Chu, Amanda (2023): US set to become world’s largest LNG exporter. Financial Times, March 14, 2023. https://www.ft.com/content/2d78c322-ac8a-4595-add6-cf182d1712d7 Zugriff: May 27, 2023.

Hodgson, Camilla und Williams, Aime (2023): Is COP28 destined to be a flop? Financial Times, March 26, 2023. https://www.ft.com/content/37d14048-f798-4c9d-b872-211447351da1 Zugriff: May 27, 2023.

Höhne, Niklas; Marquardt, Mat und Feket, Hanna (2022): Pläne für deutsche Flüssigerdgas-Terminals sind massiv überdimensioniert, 13. Dezember 2023, NewClimate Institute: Köln, 10 S. https://newclimate.org/sites/default/files/2022-12/lng_deutschland_web_0.pdf Zugriff: 23. Februar 2023.

IEA (2022): World Energy Outlook 2022, November 2022, International Energy Agency: Paris, 522 S. https://www.iea.org/reports/world-energy-outlook-2022.

IEA (2023): World Energy Investment 2023, May 25, 2023, International Energy Agency, 180 S. https://iea.blob.core.windows.net/assets/54a781e5-05ab-4d43-bb7f-752c27495680/WorldEnergyInvestment2023.pdf Zugriff: May 26, 2023.

Jacobs, Justin (2023): BP commits to Gulf of Mexico as $9bn platform comes online. Financial Times, April 13 2023. https://www.ft.com/content/1f785360-d5a4-41c6-87a0-78fb3fdb7c1a Zugriff: May 22, 2023.

Jacobs, Justin; Brower, Derek; Chu, Amanda und McCormick, Myles (2023): BP chief: Fossil fuels have done ‘enormous good’. Financial Times, May 11, 2023. https://www.ft.com/content/c87cc623-0fb2-4481-be1f-59afddd10684 Zugriff: May 27, 2023.

Lohmann, Björn (2023): LNG-Terminals: Überdimensionierter Flüssiggasausbau gefährdet Klimaziele. Riff Reporter, 19.03.2023. https://www.riffreporter.de/de/umwelt/klimakrise-gaskrise-lng-terminals-studie-energiewende-klimaziele Zugriff: 23.03.2023.

Rainforest Action und et.al. (2023): Banking on Climate Chaos. Fossil Fuel Finance Report 2023, April 12, 2023, Rainforest Action Network (RAN), BankTrack, Indigenous Environmental Network (IEN), Oil Change International (OCI), Reclaim Finance, the Sierra Club, and Urgewald, 104 S. https://www.bankingonclimatechaos.org/wp-content/uploads/2023/05/BOCC_2023_vF-05-08.pdf Zugriff: May 20, 2023.

Schlund, David; Gierkink, Max; Moritz, Michael; Kopp, Jan; Junkermann, Jakob; Diers, Hendrik und Vey, Meike (2023): Analyse der globalen Gasmärkte bis 2035. Szenariobasierte Modellsimulation und Gasbilanzanalyse, 27.01.2023, Energiewirtschaftliches Institut an der Universität zu Köln (EWI): Köln. https://www.ewi.uni-koeln.de/cms/wp-content/uploads/2023/03/EWI_Gasszenarien-mit-Bilanzanalyse_2023-02-10.pdf Zugriff: 23.03.2023.

Streeck, Johannes (2023): Der Boom von Öl und Gas in den USA. 17. Mai 2023. Rosa Luxemburg Stiftung. https://www.rosalux.de/news/id/50444/der-boom-von-oel-und-gas-in-den-usa. Zugriff 22. Mai 2023

Wilson, Tom (2023): Solar power investment to exceed oil for first time, says IEA chief. Financial Times, March 25, 2023. https://www.ft.com/content/990d3ce2-cdc1-4496-ac34-9ba20e0dcaa4 Zugriff: May 27, 2023.

Wilson, Tom und Dunkley, Emma (2023): BP slows oil and gas retreat after record $28bn profit. Financial Times, February 7, 2023. https://www.ft.com/content/419f137c-3a83-4c9c-9957-34b6609bcdf7 Zugriff: May 22, 2023.

Zeller, Christian (2023): Geopolitik zur Geoökonomie. Die langfristige strategische deutsch-russische Energiepartnerschaft und ihr Ende. emanzipation – Zeitschrift für ökosozialistische Strategie 7 (1), S. 69-120. https://emanzipation.org/wp-content/uploads/2023/05/Zeller_2023_Geopolitik_Geooekonomie_emanzipation_7-1.pdf.